June 2018 Used Vehicle Market Conditions

Current Used Vehicle Market Conditions

March 2018 Kontos Kommentary

By Tom Kontos Executive Vice President, ADESA Analytical Services

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services.

As part of the KAR Auction Services family, ADESA works in collaboration with its sister company, Insurance Auto Auctions, a leading salvage auto auction company, to provide insights, trends and highlights of the entire automotive auction industry.

Summary

Average wholesale used vehicle market prices registered their first year-over-year price decline since August 2014, continuing the general softening pattern seen since the impact of the hurricanes waned in late 2017. Retail used vehicle sales, including CPO sales, were strong, reflecting Spring, tax-season demand.

Details

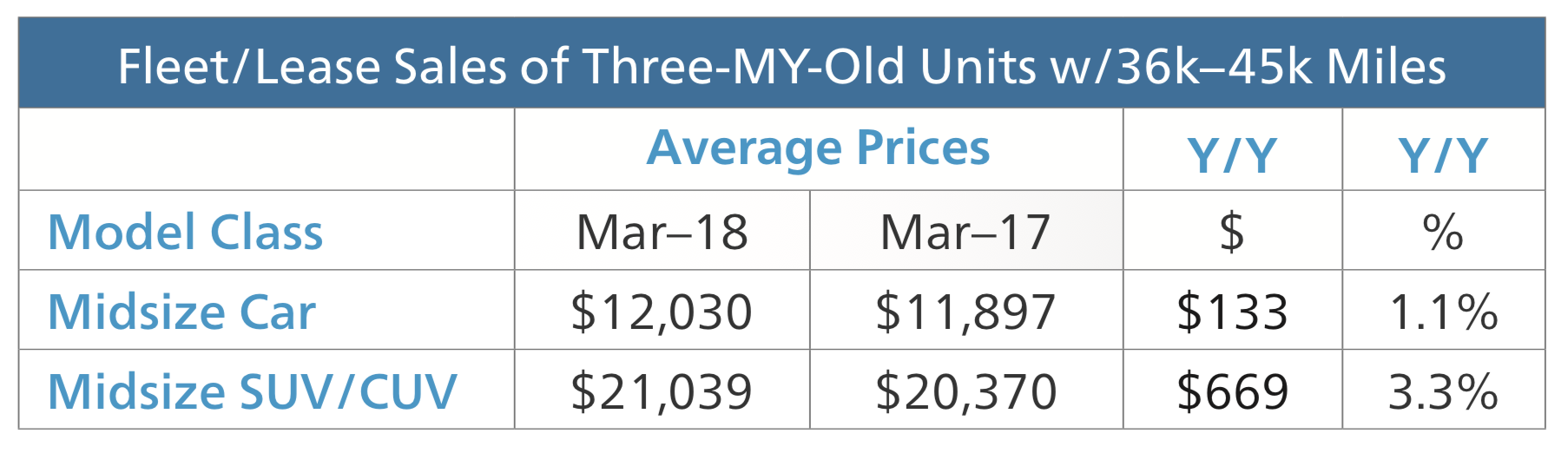

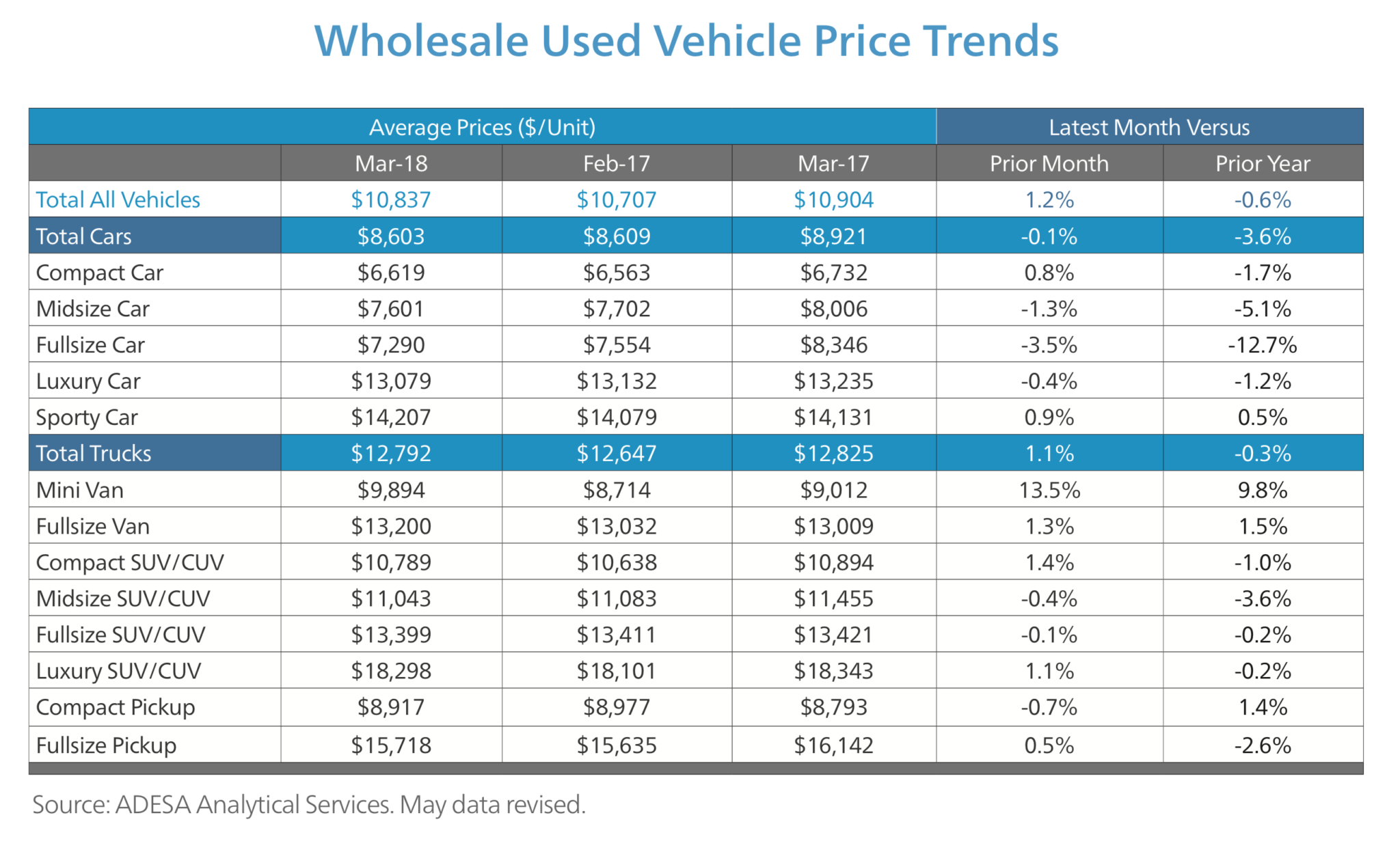

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class1, wholesale used vehicle market prices in March averaged $10,837 – up 1.2% compared to February but down 0.6% relative to March 2017. Average prices were down on a year-over-year basis for both cars and trucks, with trucks registering their first year-over-year price decline since July 2013. When holding constant for sale type, model-year age, mileage, and model class segment, prices were up on a year-over-year basis for both midsize cars and midsize SUV/CUVs, as seen in the following table:

This analysis indicates that wholesale values for of-lease units are holding up well despite the overall softening market trend. Average wholesale prices for used vehicles remarketed by manufacturers were up 1.6% month-over-month and up 9.2% year-over-year. Prices for feet/lease consignors were up 6.6% sequentially and up 4.9% annually. Average prices for dealer consignors were up 3.5% versus February and down 0.8% relative to March 2017 Retail used vehicle sales by franchised dealers were up 8.9% year-over-year and were up 7.3% for independent dealers. March CPO sales were up 22.0% from the prior month and up 6.4% year-over-year, according to figures from Autodata. On a year-to-date basis, CPO sales are up 4.2% versus last year.