New Vehicle Sales

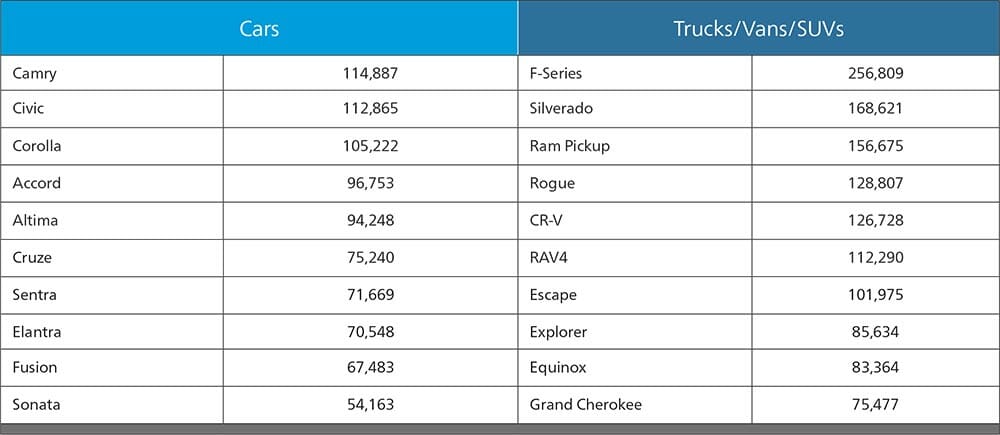

WardsAuto 10 Best-Selling U.S. Cars and Trucks

As of April 2017

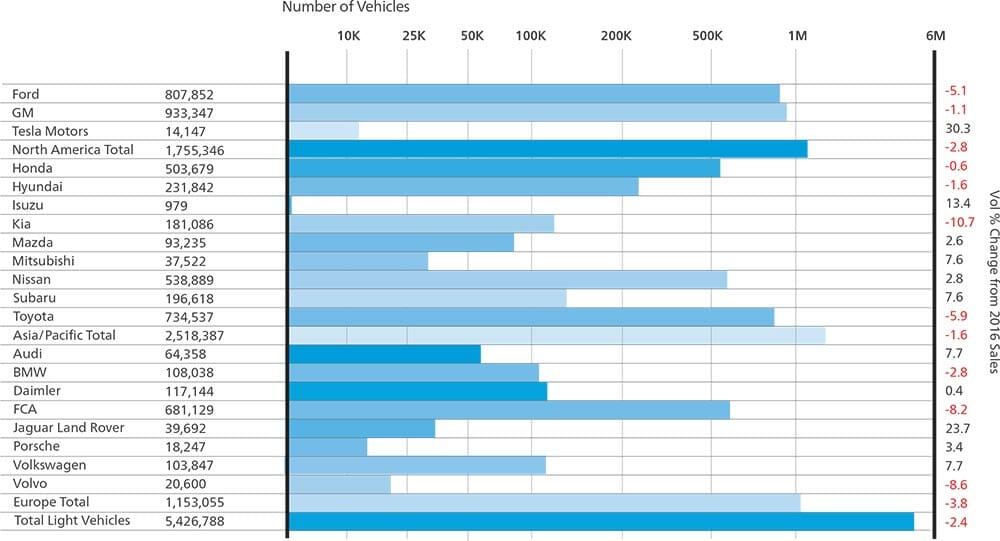

WardsAuto U.S. Light Vehicle Sales by Company

April 2017

Current Used Vehicle Market Conditions

December 2016 Kontos Kommentary

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services. As part of the KAR Auction Services family, ADESA works in collaboration with its sister company, Insurance Auto Auctions, a leading salvage auto auction company, to provide insights, trends and highlights of the entire automotive auction industry.

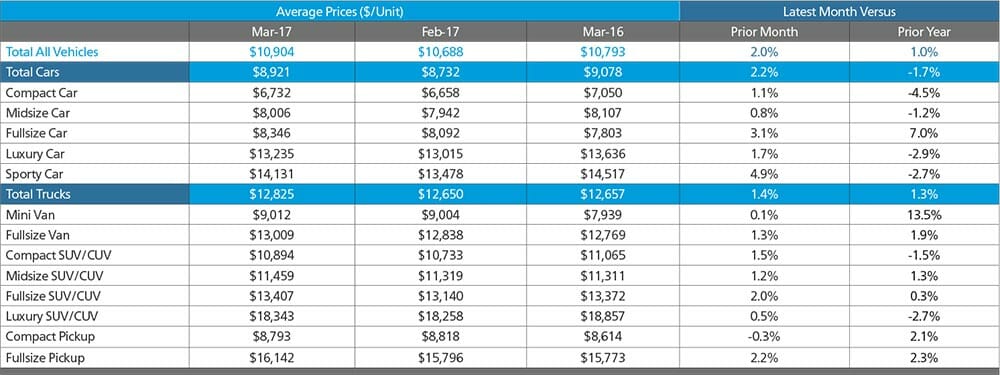

Wholesale Used Vehicle Price Trends

Source: ADESA Analytical Services. March revised.

Summary

The tale of two markets resumed in March, as wholesale prices were below year-ago levels for cars and above prior year for trucks. Nevertheless, both groups showed price increases versus February’s unseasonably soft results, as retail sales and wholesale activity showed signs of the traditional spring/tax season market typical for used vehicles. In analyzing the current bifurcated market, it seems timely to revisit a study begun during the first episode of $4.00 gas in 2008, when truck prices softened dramatically and car prices rose. At that time, the price gap between fullsize SUVs and compact cars had fallen from close to $13,000 in January of 2000, when SUVs were all the rage, to $2,162 in June of 2008, when gas prices hit $4.00 a gallon. In other words, dealers were paying high prices for small cars and low prices for big SUVs at that time, narrowing the price gap between the two. That turned out to be the all-time low for this price gap, which gradually rose to $8,293 by November 2016, as gas prices have fallen and the popularity of SUVs has recovered. Per our March data, this gap has dropped to $6,675, perhaps indicating that SUV prices are moderating and compact car prices are recovering. We will monitor this going forward.

Details

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class1, wholesale used vehicle prices in March averaged $10,904 —up 2.0% compared to February and up 1.0% relative to March 2016. All but one model class segment (compact pickups) showed month-over-month increases. (Note: the year-over-year growth in minivan prices is exaggerated by newer models as discussed in January’s report.) Average wholesale prices for used vehicles remarketed by manufacturers were up 1.1% month-over-month but down 1.7% year-over-year. Prices for fleet/lease consignors were up 3.8% sequentially and up 0.8% annually. Average prices for dealer consignors were up 2.7% versus February and up 1.3% relative to March 2016. Breaking the data down by age shows that prices were down 2.5% year-over-year for current and one-model-year-old units (typically off-rental units) and down 2.6% for three-model-year-old units (a good proxy for off-lease units). Based on NADA data, retail used vehicle sales by franchised and independent dealers were up 9.3% month-over-month, and up 1.6% year-over-year. March CPO sales were up 15.0% month-over-month, although they were down 0.3% year-over-year from last March’s all-time record levels, according to figures from Autodata.