New Vehicle Sales

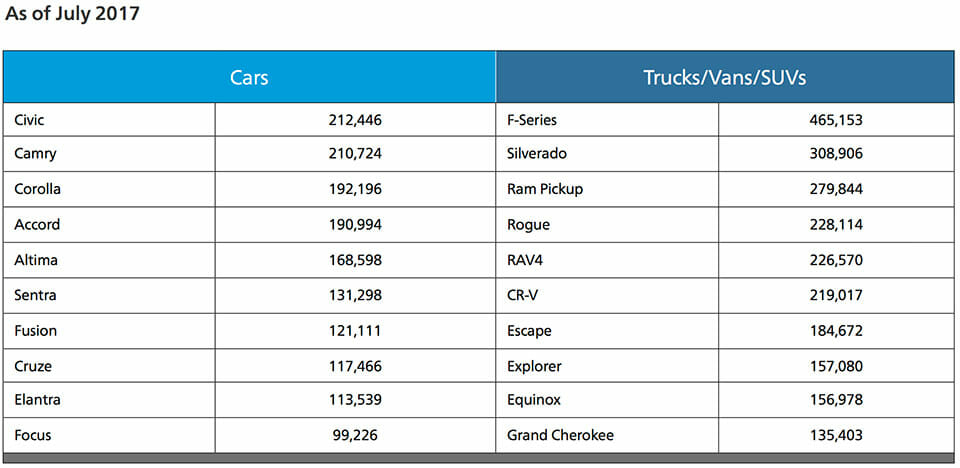

WardsAuto 10 Best-Selling U.S. Cars and Trucks

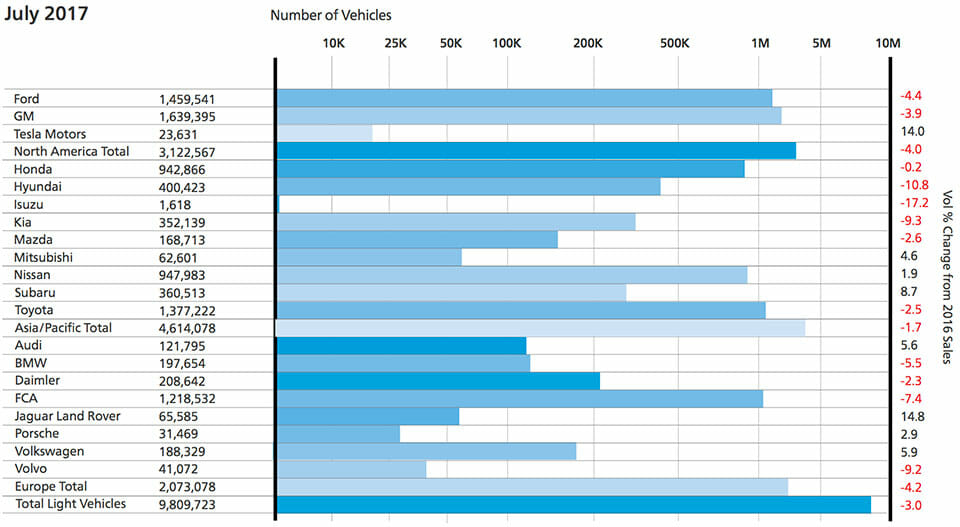

WardsAuto U.S. Light Vehicle Sales by Company

Current Used Vehicle Market Conditions

June 2017 Kontos Kommentary

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services. As part of the KAR Auction Services family, ADESA works in collaboration with its sister company, Insurance Auto Auctions, a leading salvage auto auction company, to provide insights, trends and highlights of the entire automotive auction industry.

Wholesale Used Vehicle Price Trends

Summary

Average wholesale prices in June were down versus May but up on a year-over-year basis. However, drilling down into the data once again clearly reveals price softening on a year-over-year basis when accounting for sale type, vehicle age, model class and mileage.

Details

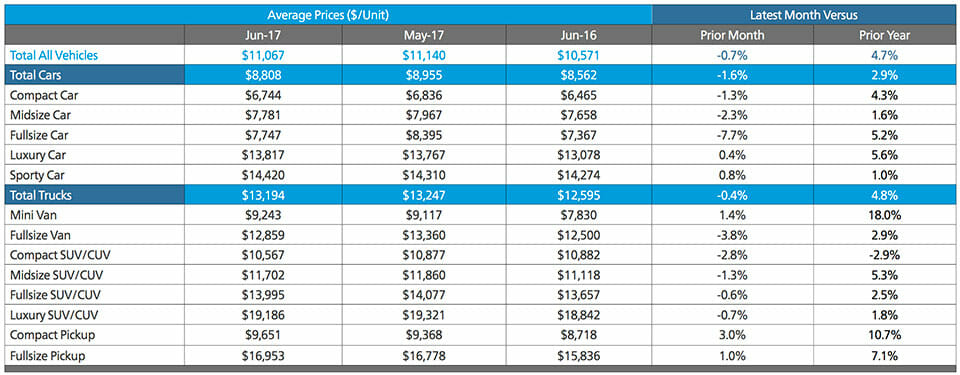

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class, wholesale used vehicle prices in June averaged $11,067 -- down 0.7% compared to May and up 4.7% relative to June 2016. Compact and fullsize pickup trucks and minivans showed significant average price gains for the month, while most other model classes registered month-over-month declines or modest increases. (Note: the year-over-year growth in minivan prices is exaggerated by newer models as discussed in January’s report.) Average wholesale prices for used vehicles remarketed by manufacturers were down 1.0% month-over-month and down 1.9% year-over-year. Prices for fleet/lease consignors were down 1.1% sequentially and up 3.2% annually. Average prices for dealer consignors were up 0.9% versus May and up 7.7% relative to June 2016. Price softening continues to be evident when holding constant for sale type, model-year age, mileage, and model class segment:

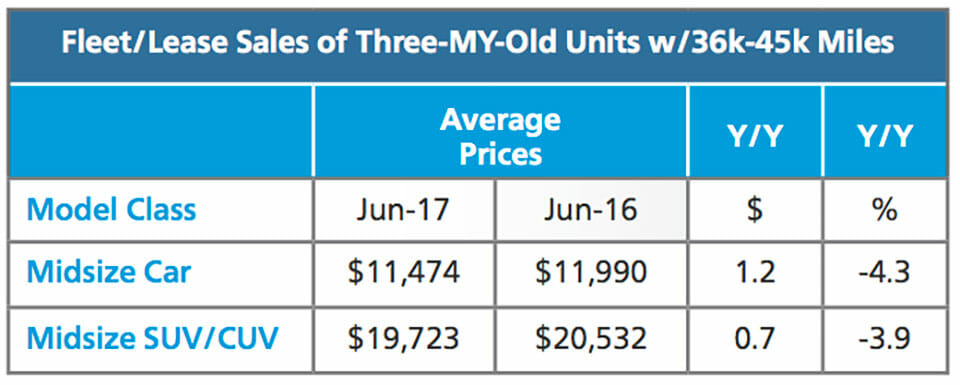

As the table shows, average prices for both of these two bellwether car and truck segments were down by about four percent year-over-year, reflecting growth in off-lease supply. June CPO sales were down 6.6% month-over-month and 0.8% year-over-year according to figures from Autodata, but remain up 1.2% on a year-to-date basis.