New Vehicle Sales

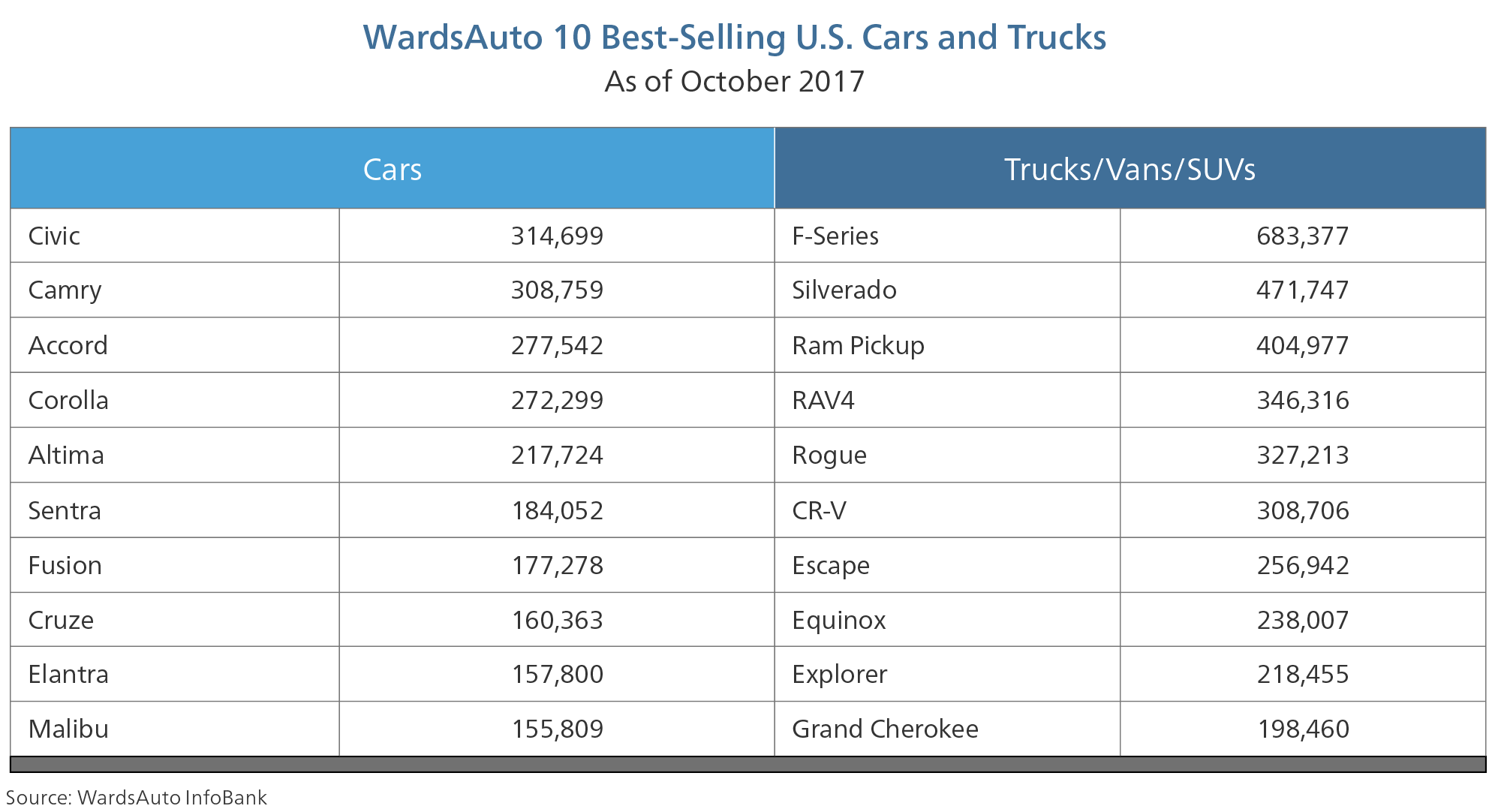

WardsAuto 10 Best-Selling U.S. Cars and Trucks

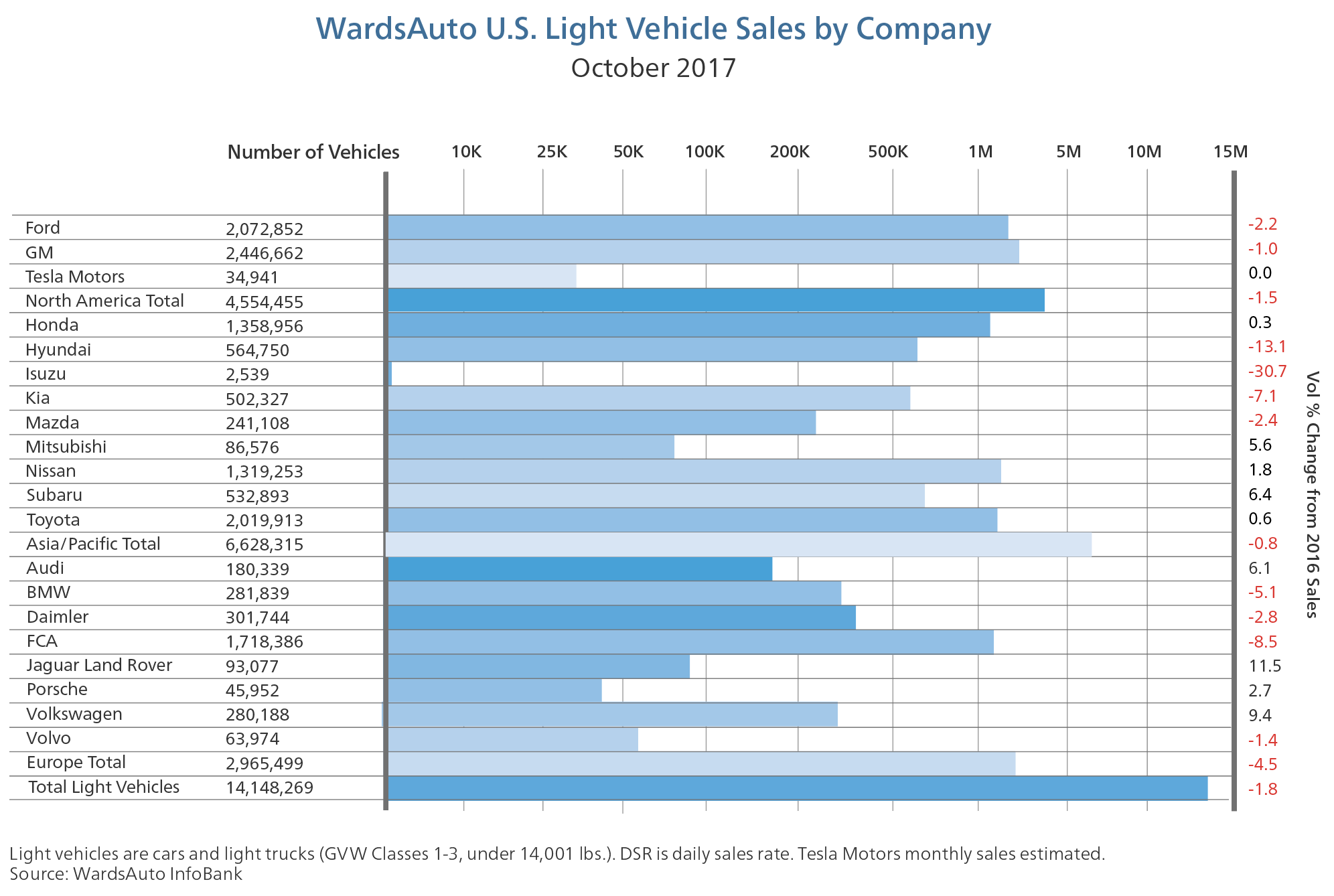

WardsAuto U.S. Light Vehicle Sales by Company

Current Used Vehicle Market Conditions

October 2017 Kontos Kommentary

By Tom Kontos Executive Vice President, ADESA Analytical Services

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services.

As part of the KAR Auction Services family, ADESA works in collaboration with its sister company, Insurance Auto Auctions, a leading salvage auto auction company, to provide insights, trends and highlights of the entire automotive auction industry.

Summary

Average wholesale prices in October were down only modestly month-over-month and were up year-over-year, bolstered by lingering impacts from hurricanes Harvey and Irma.

Details

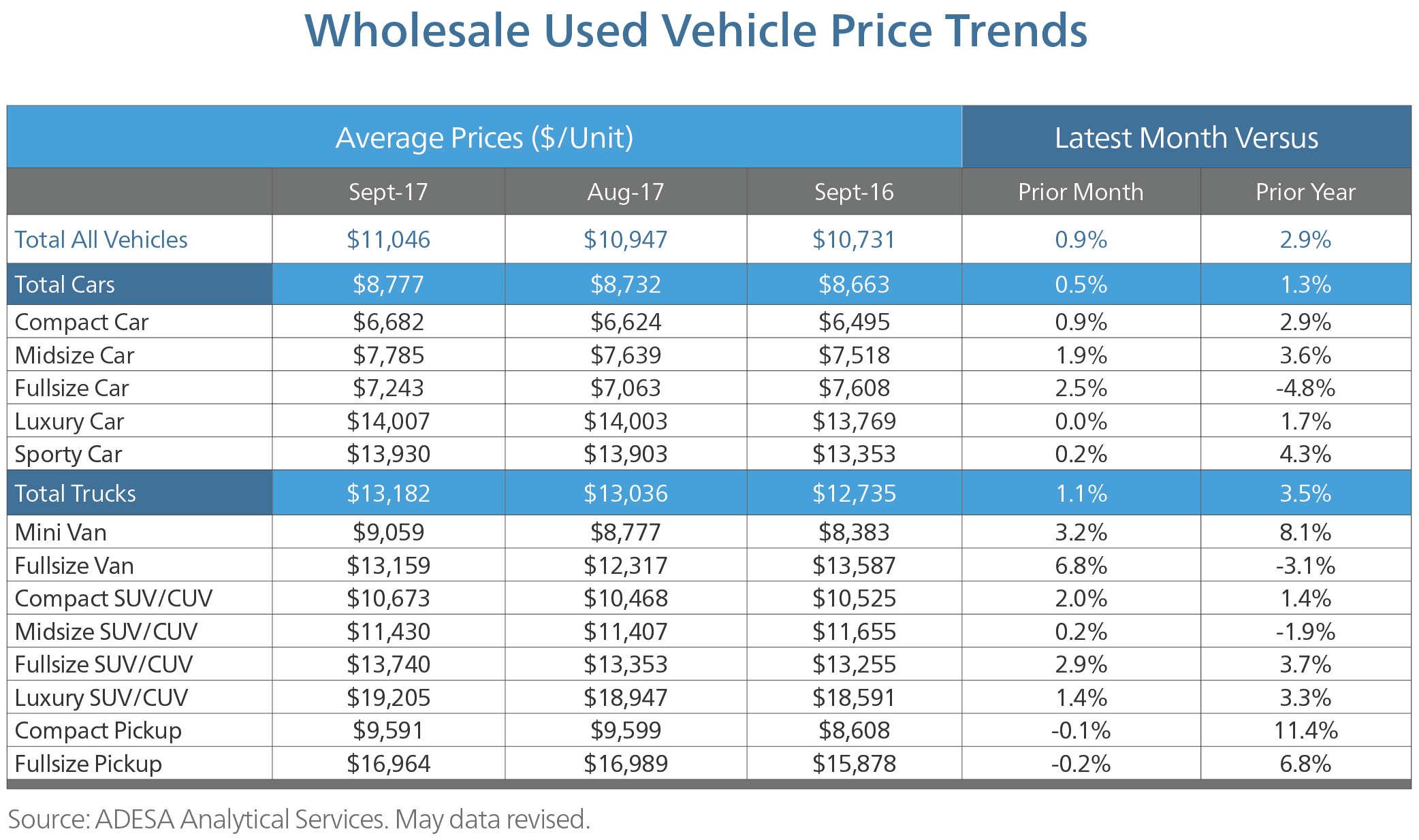

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class1, wholesale used vehicle prices in October averaged $10,977—down 0.6% compared to September and up 4.2% relative to October 2016. Prices were flat or down on a month-over-month basis for all model class segments, but were up year-over-year for all but fullsize cars.

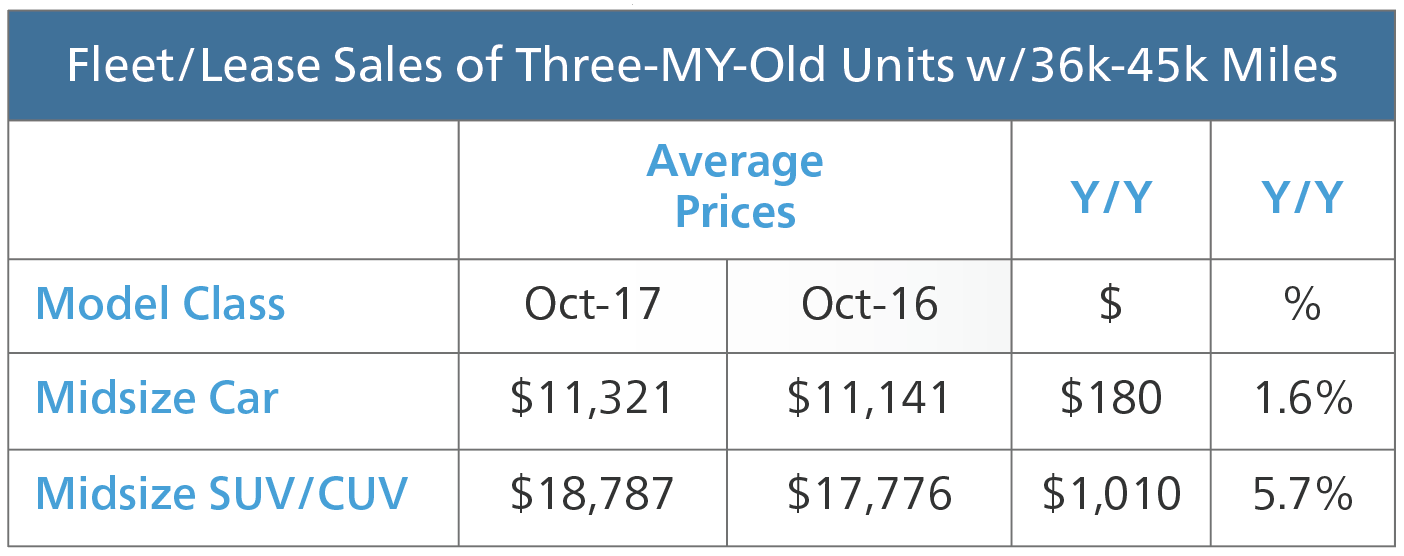

Prices were up on an annual basis even when holding constant for sale type, model-year age, mileage, and model class segment, as seen in the following table:

Strong truck demand in Texas in the aftermath of Harvey may be a contributing factor to the strength of Midsize SUV/CUV prices. Average wholesale prices for used vehicles remarketed by manufacturers were up 0.6% month-over-month and up 5.7% year-over-year. Prices for fleet/lease consignors were down 1.6% sequentially but up 4.5% annually. Average prices for dealer consignors were down 0.3% versus September and up 7.5% relative to October 2016. October CPO sales were down 9.8% from the prior month and down 3.3% year-over-year, but are up 0.6% on a year-to-date basis, according to figures from Autodata.