We recap the motor vehicle markets trends from Q4 2017, highlighting the best-selling U.S. cars, trucks, and current used vehicle market conditions.

New Vehicle Sales

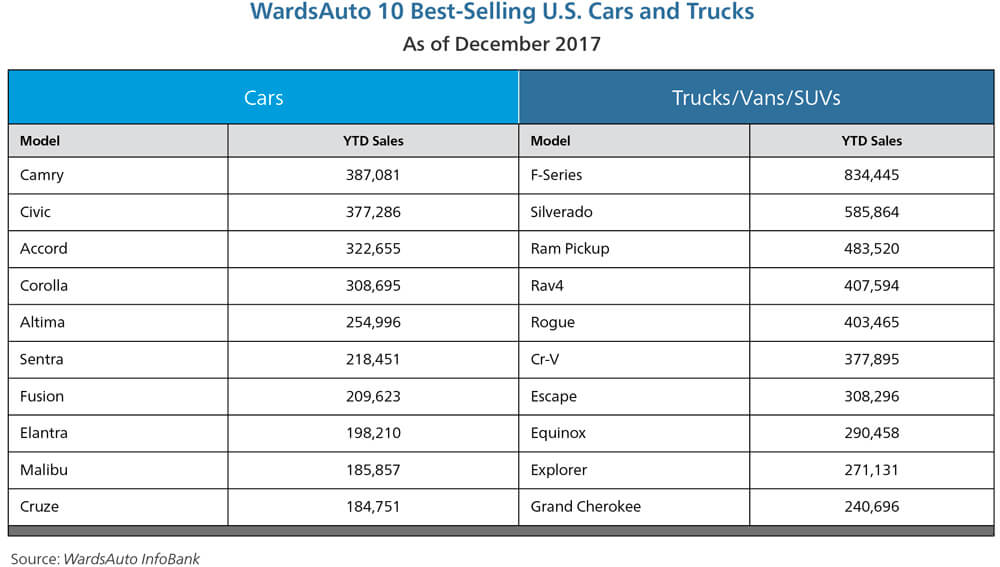

WardsAuto 10 Best-Selling U.S. Cars and Trucks

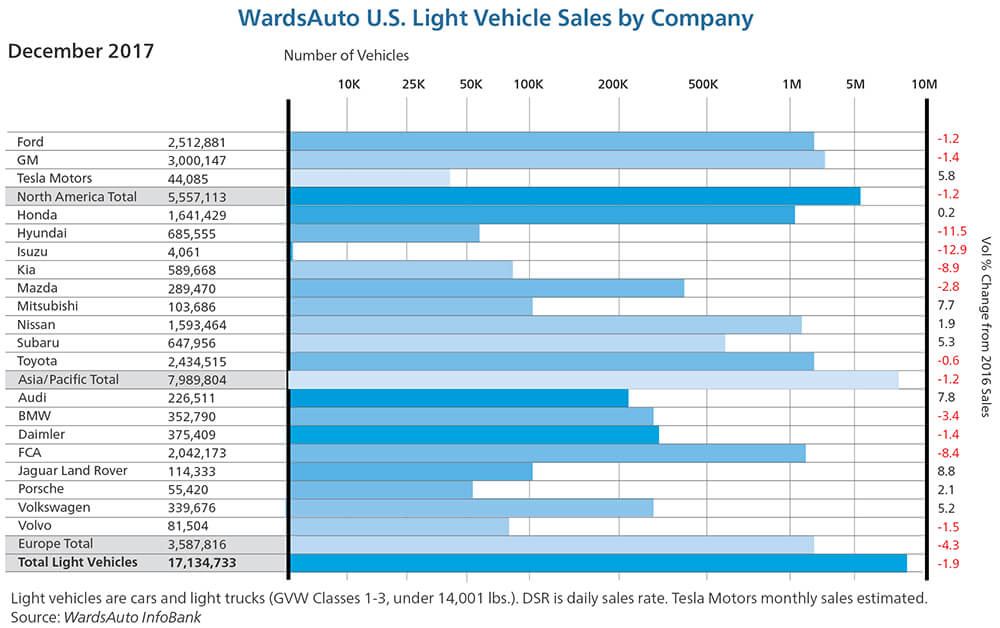

WardsAuto U.S. Light Vehicle Sales by Company

Current Used Vehicle Market Conditions

December 2017 Kontos Kommentary

By Tom Kontos Executive Vice President, ADESA Analytical Services

The following commentary is produced monthly by Tom Kontos, Executive Vice-President, ADESA Analytical Services. ADESA is a leading provider of wholesale used vehicle auctions and ancillary remarketing services.

As part of the KAR Auction Services family, ADESA works in collaboration with its sister company, Insurance Auto Auctions, a leading salvage auto auction company, to provide insights, trends and highlights of the entire automotive auction industry.

Summary

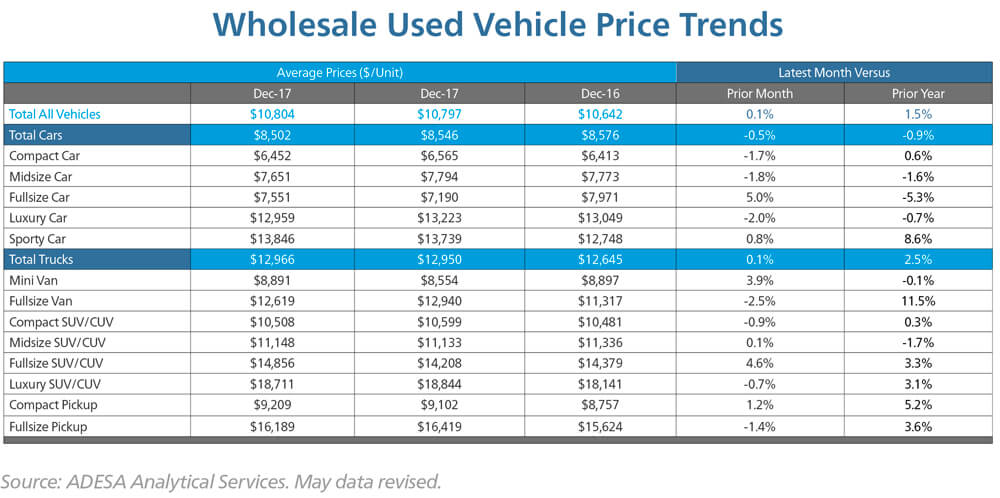

With the impacts of Hurricanes Harvey and Irma having lasted primarily from late-August through mid-November, wholesale prices in December returned to patterns seen prior to those events. Namely, prices for cars continue to soften while prices for trucks were up.

Details

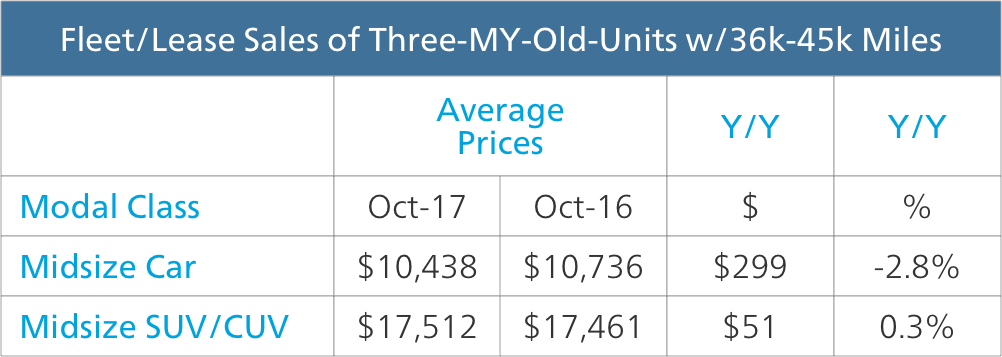

According to ADESA Analytical Services’ monthly analysis of Wholesale Used Vehicle Prices by Vehicle Model Class1, wholesale used vehicle prices in December averaged $10,804—up 0.1% compared to November and up 1.5% relative to December 2016. However, car prices were down both month-over-month and year-over-year, while the opposite was true for truck prices. When holding constant for sale type, model-year age, mileage, and model class segment, midsize car prices were down on a year-over-year basis, while midsize SUV/Crossover prices were up, as seen in the following table:

Although Midsize SUV/CUV prices were up in December in this analysis, the increase was modest compared to September through November. This may be indicative of a cessation in truck demand growth in Texas after Hurricane Harvey. Average wholesale prices for used vehicles remarketed by manufacturers were down 3.3% month-over-month but up 8.3% year-over-year. Prices for fleet/lease consignors were down 1.9% sequentially but up 0.4% annually. Average prices for dealer consignors were down 0.1% versus November and up 3.6% relative to December 2016.

Based on NADA data, December retail used vehicle sales by franchised and independent dealers were down a combined 3.4% year-over-year, after being down in October and November as well. December CPO sales were up 9.0% from the prior month and down 4.8% year-over-year, according to figures from Autodata.

1 The analysis is based on over seven million annual sales transactions from over 150 of the largest U.S. wholesale auto auctions, including those of ADESA as well as other auction companies. ADESA Analytical Services segregates these transactions to study trends by vehicle model class, sale type, model year, etc.The views and analysis provided herein relate to the vehicle remarketing industry as a whole and may not relate directly to KAR Auction Services, Inc. The views and analysis are not the views of KAR Auction Services, its management or its subsidiaries; and their accuracy is not warranted. The statements contained in this report and statements that the company may make orally in connection with this report that are not historical facts are forward-looking statements. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “bode”, “promises”, “likely to” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the company’s Securities and Exchange Commission filings. The company does not undertake any obligation to update any forward-looking statements.