March and April 2020 Kontos Kommentary

The following commentary is produced monthly by Tom Kontos, Chief Economist, KAR Global. KAR Global is a leading provider of wholesale used vehicle auctions and ancillary remarketing services.1

Summary

After a strong start to 2020 in January and February, the COVID-19 crisis wiped out gains in wholesale prices in virtually all categories. March and April average prices fell a cumulative 15.1% after peaking in February, and April’s 16.3% year-over-year drop is the largest ever in the data series used by KAR Global Analytical Services, which tracks data back to 1994. On the retail front, used vehicle sales and CPO sales were down significantly (around 40% or higher year-on-year).

Details

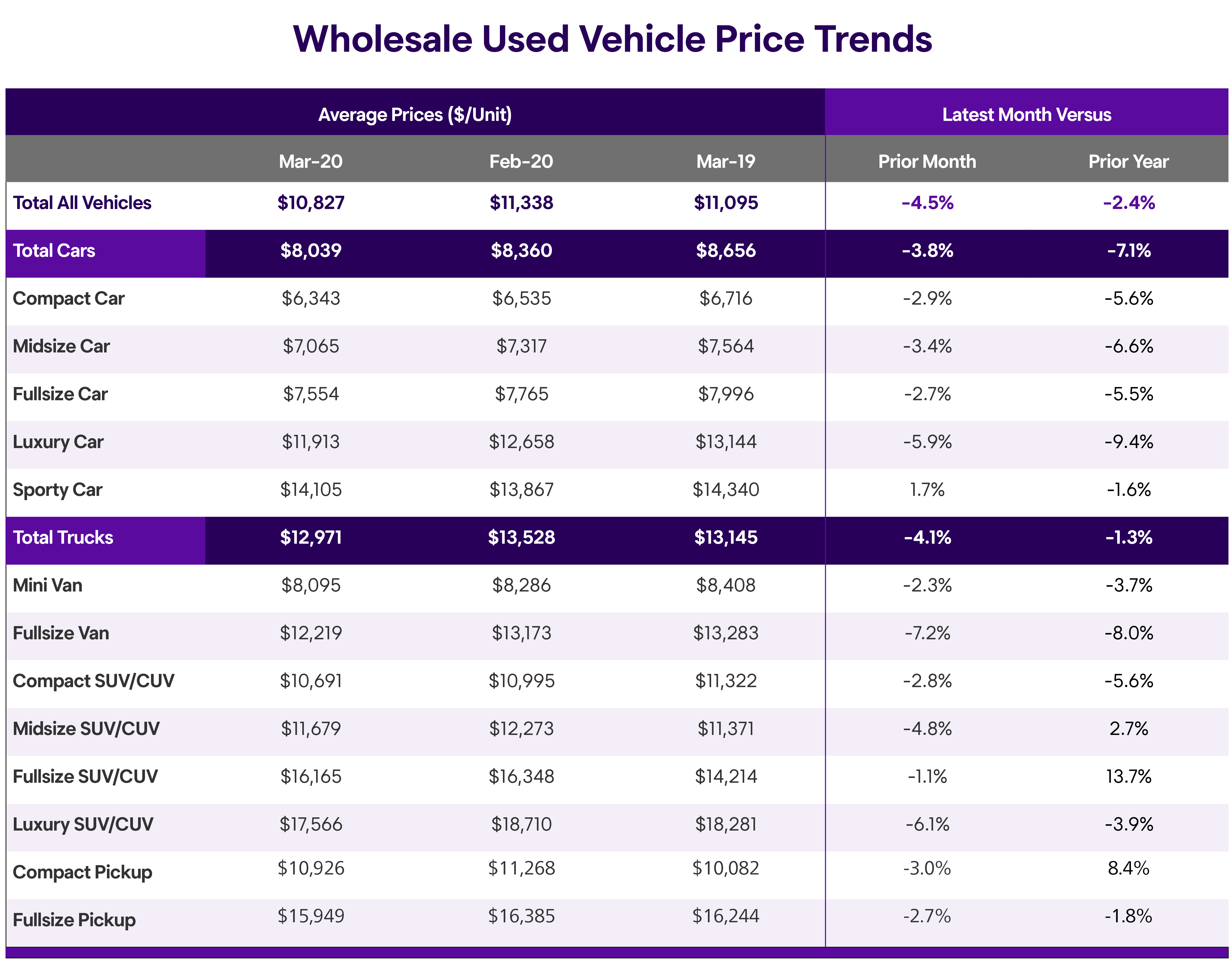

According to KAR Global Analytical Services’ monthly analysis of wholesale used vehicle prices by vehicle model class, wholesale prices in March averaged $10,827—down 4.5% compared to February and down 2.4% relative to March 2019, as seen in the following table:

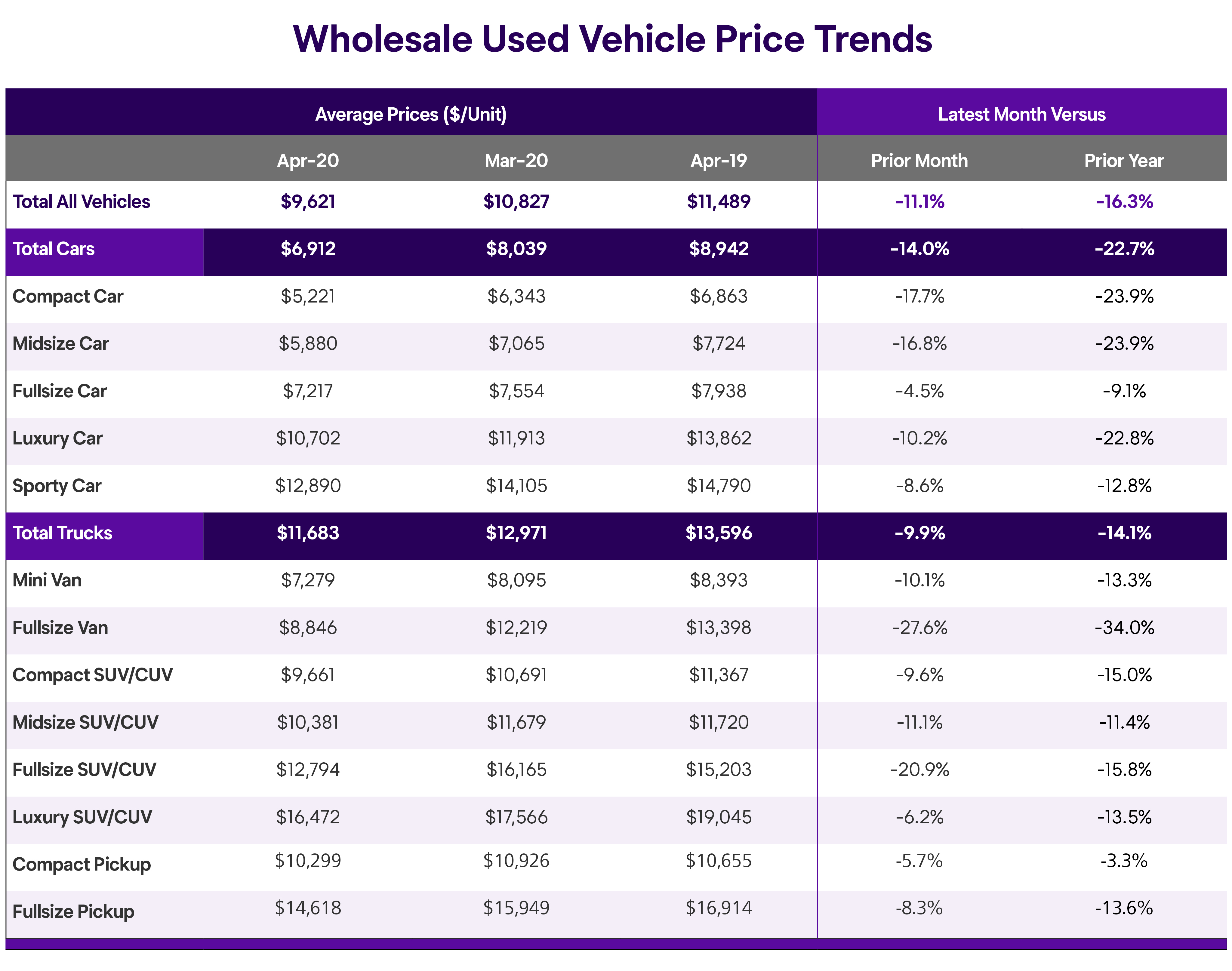

In April, average prices dropped another 11.1% compared to March and are down 16.3% versus April 2019, as the following table shows:

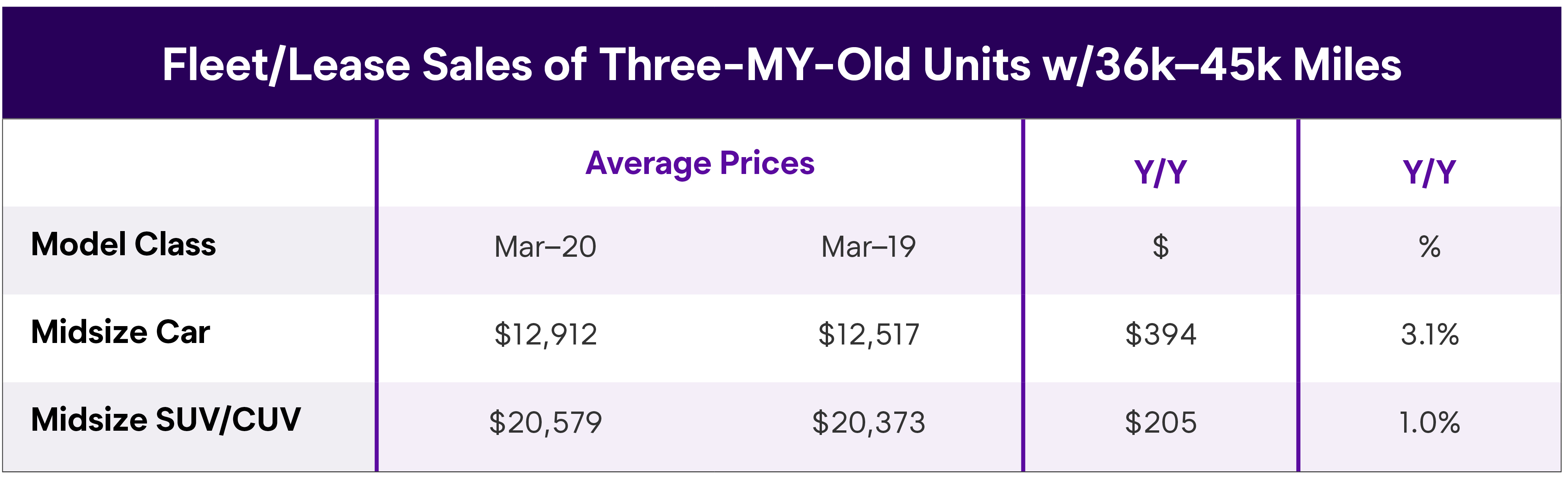

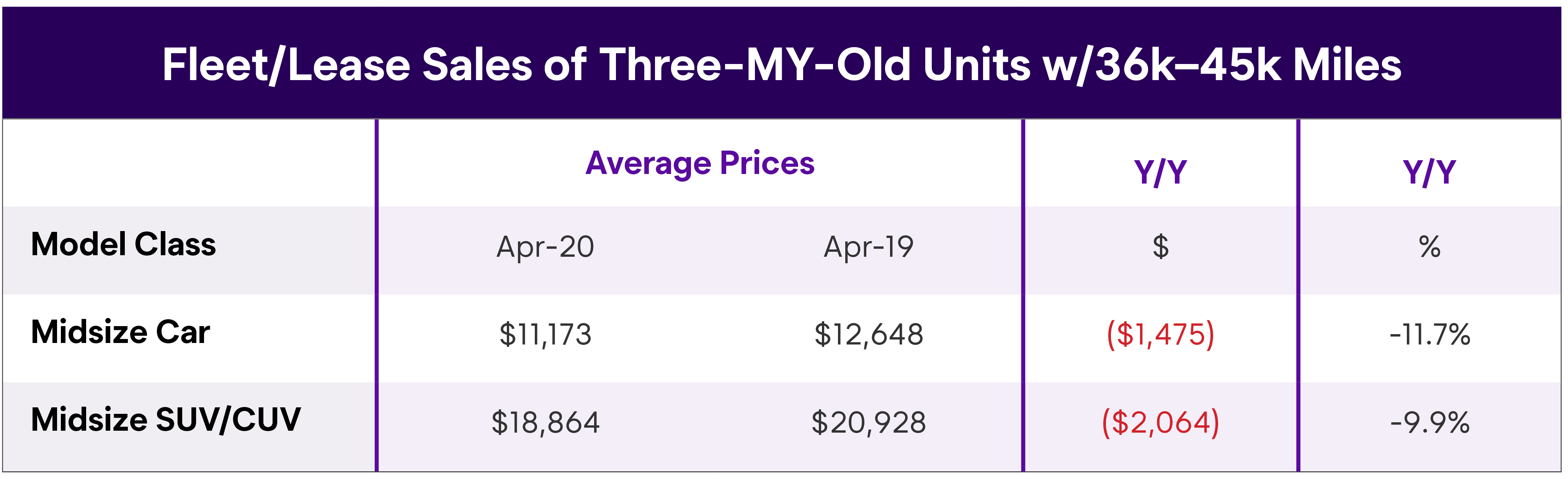

All model class segments experienced month-over-month and year-over-year price declines, many in the double-digits. When holding constant for sale type, model-year-age, mileage and model class segment—using criteria that characterize off-lease units—prices were up on a year-over-year basis for both midsize cars and midsize SUV/CUVs in March, but down for both segments in April, as seen in the following tables:

April’s price declines for off-lease units more than offset any lingering pre-crisis price gains in early March. Similarly, prices by major seller type were down significantly by April. Average wholesale prices for used vehicles remarketed by manufacturers were up 4.3% month-over-month in March (due to pre-crisis price strength in early March), but this was more than wiped out by a 12.9% drop in April, leaving prices down 8.2% year-over-year. Prices for fleet/lease consignors were down 3.8% sequentially in March and another 13.9% in April, leaving them down 20.0% annually. Average prices for dealer consignors were down 3.4% and 10.5%, respectively in March and April, leaving them down 14.9% relative to April 2019. Based on NADA data, retail used vehicle sales by franchised and independent dealers were down 38.2% month-over-month and down 40.5% year-over-year in March (April data unavailable at time of this report). March CPO sales were down 32.5% from the prior month and down 39.5% year-over-year, according to figures from Autodata. In April, CPO sales dropped another 21.0% sequentially, leaving them down 45.6% year-over-year.