July/August 2023 Kontos Kommentary

The following commentary is produced by Tom Kontos, Chief Economist, ADESA Auctions.1

Summary

Average wholesale prices declined for the third month in July, although at a slightly more gradual rate than in June. Prices have so far stabilized in August and remain up by around 30% versus pre-pandemic.

Retail used vehicle sales remain soft, but Certified Pre-Owned (CPO) sales are a bright spot. Both trends reflect consumer concerns about vehicle affordability. In the case of overall used vehicle sales, consumers are pushing back on still-high used vehicle prices and abstaining from purchasing altogether; in the case of CPO sales, consumers are pushing back on still-high new vehicle prices and purchasing used vehicles instead.

Wholesale Market Trends*

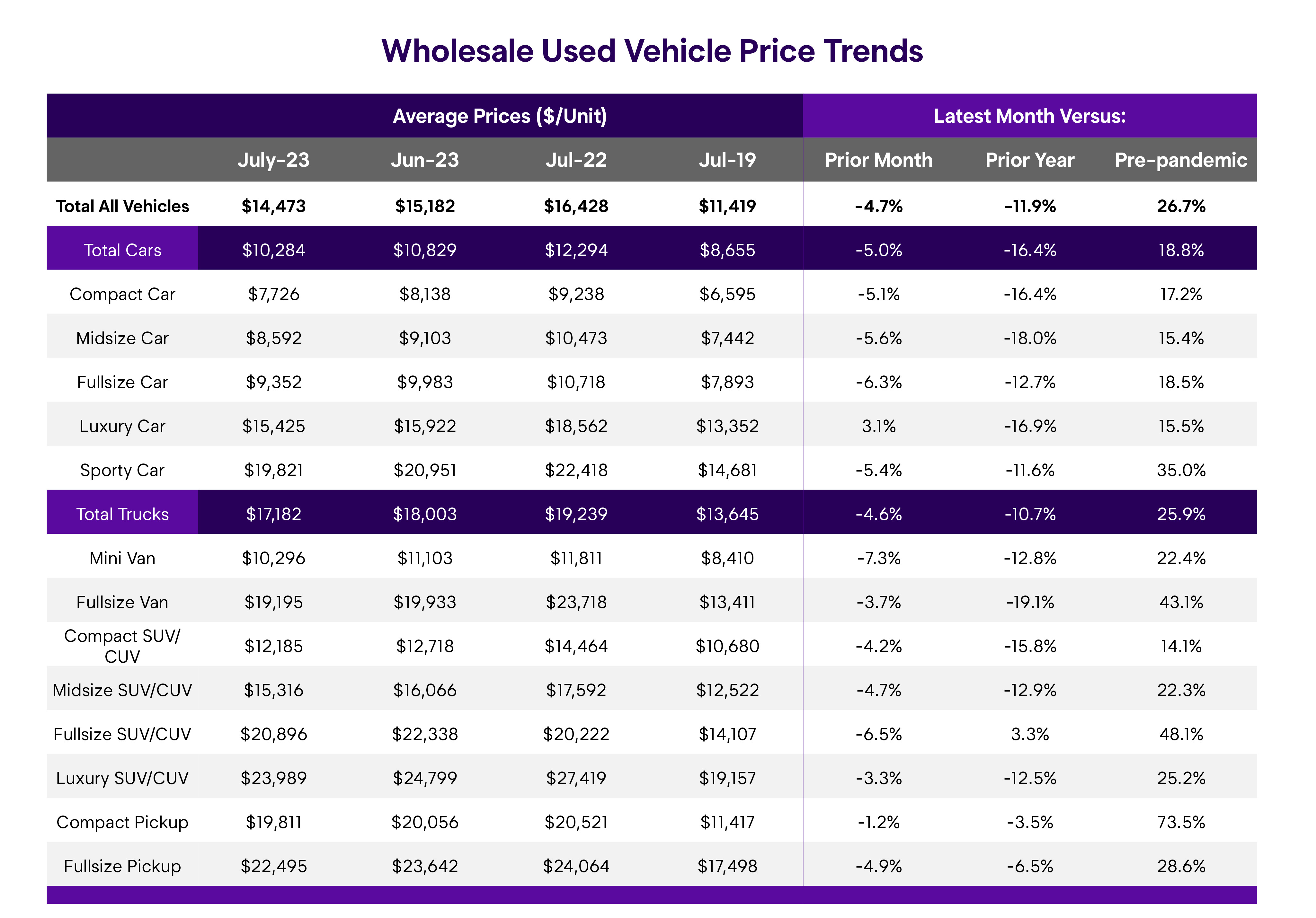

According to ADESA US Analytical Services’ monthly analysis of auction industry used vehicle prices by vehicle model class, wholesale prices in July averaged $14,473—down 4.7% compared to June, down 11.9% relative to July 2022, and up 26.7% versus pre-pandemic/July 2019, as seen below.

Average prices have stabilized so far in August and stood at $14,423 for the week ending August 13.

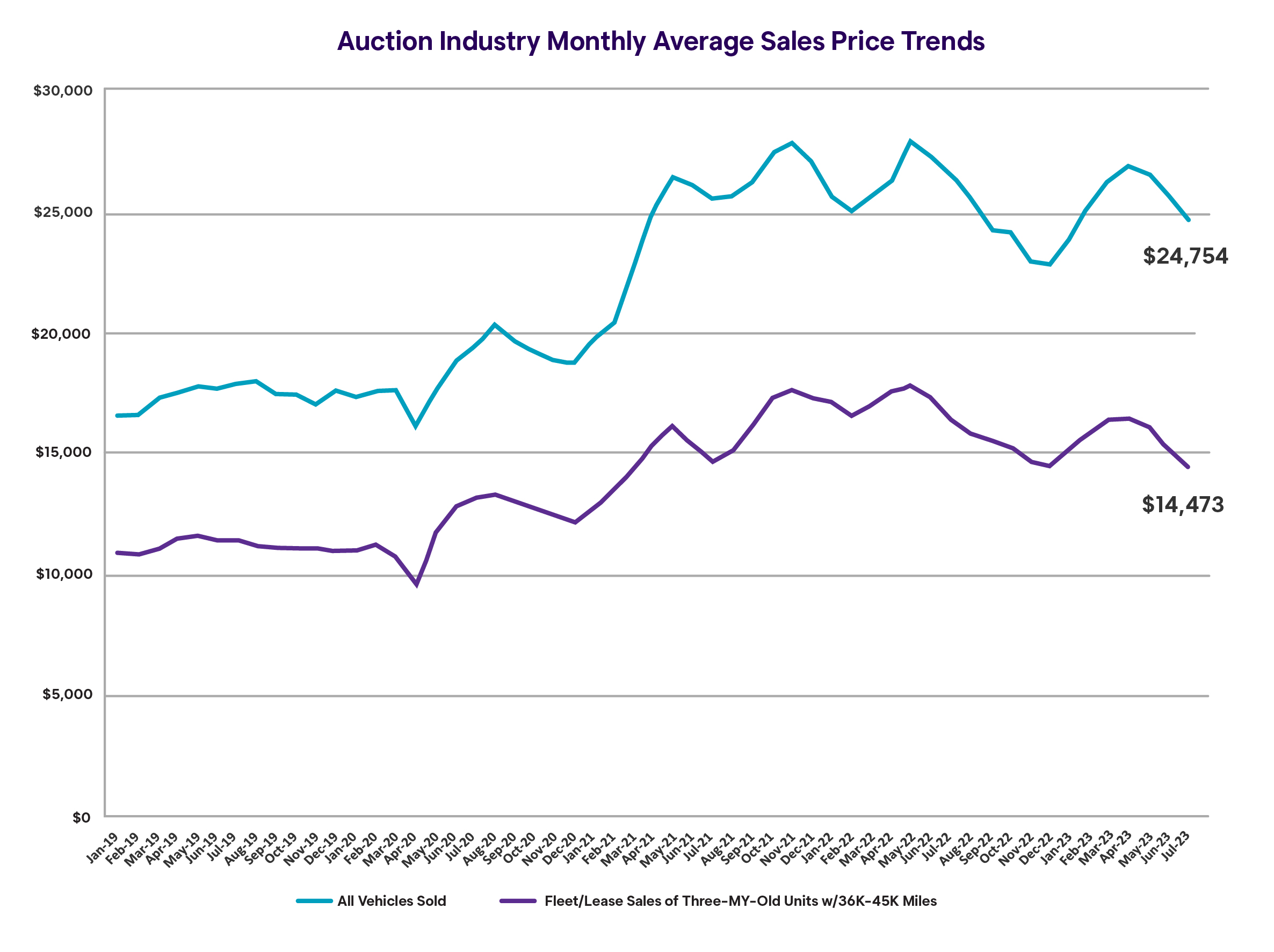

Further insights on wholesale price trends can be gained by holding constant for auction sale type, model-year age and mileage (the upper line in the following graph, which represents “Late-Model” units), as well as price trends for all vehicles sold (the lower line in the graph below).

Average prices for “Late-Model” used vehicles as defined here have also stabilized in August and stood at $24,719 for the week ending August 13.

Retail Market Trends

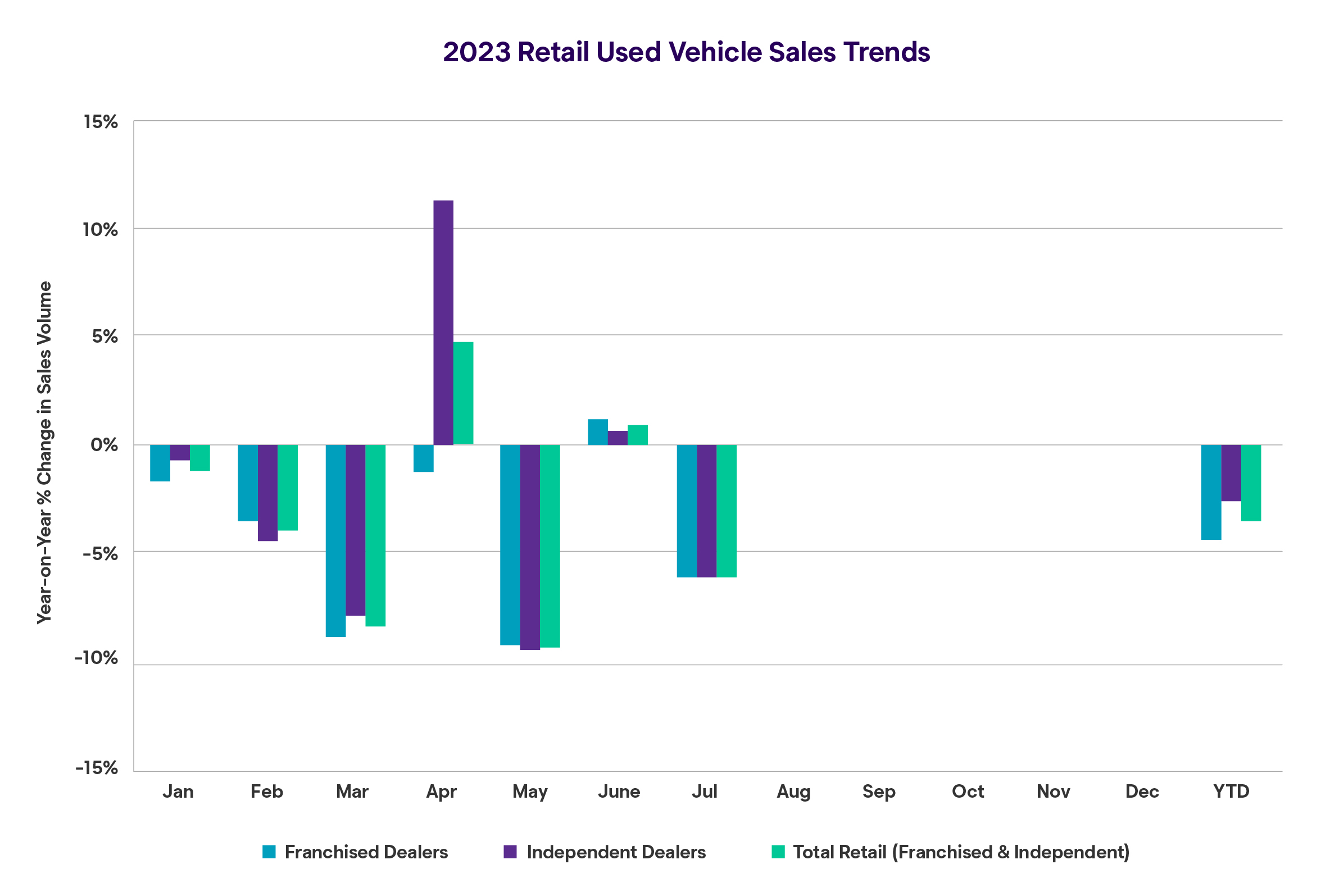

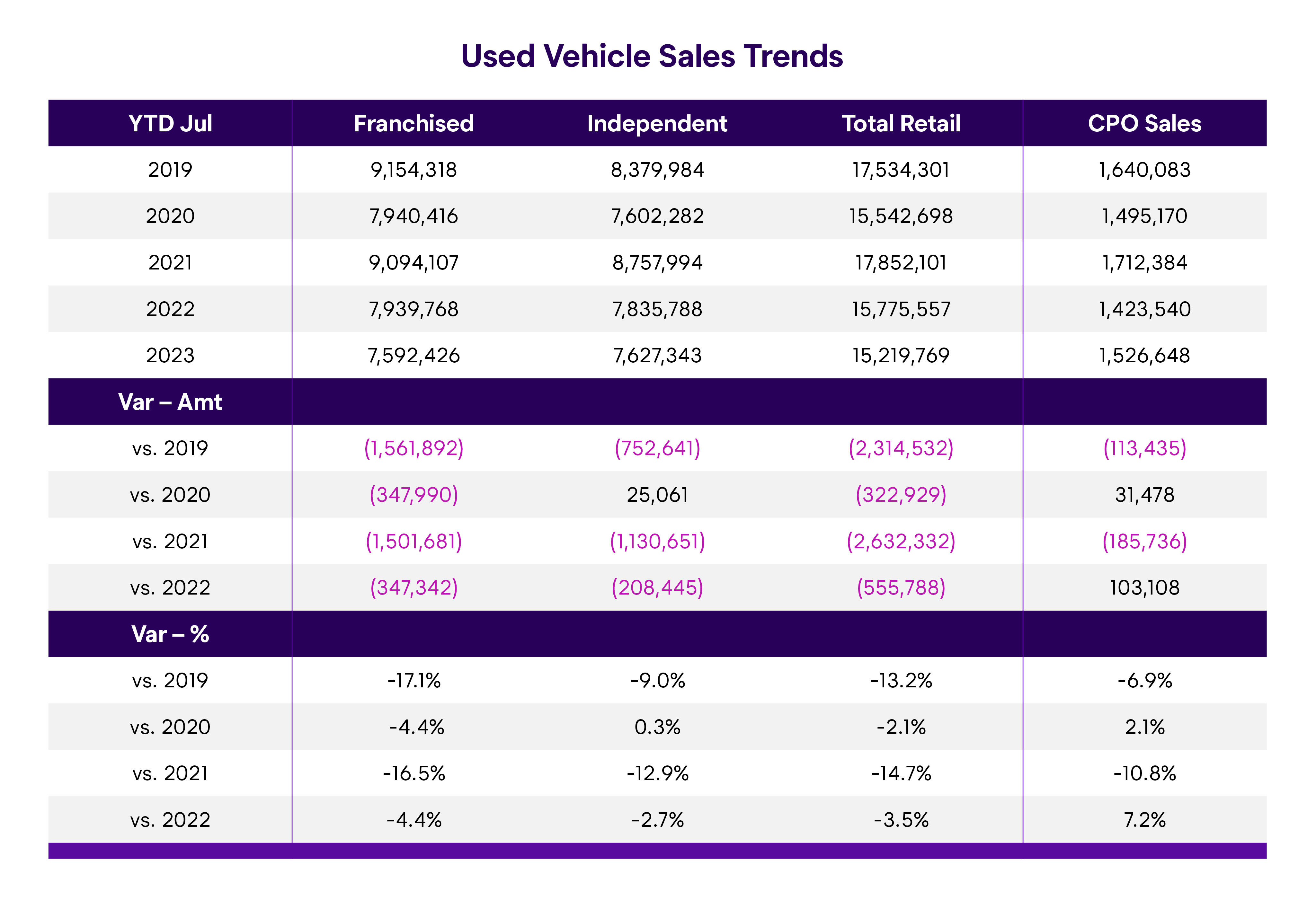

The following graph and table summarize data on retail used vehicle and CPO sales through July based on ADESA US Analytical Services’ analysis of data from NADA and Motor Intelligence, respectively.

Retail used vehicle sales continue to be soft and down on a year-over-year basis. CPO sales are a bright spot, as consumers seek more affordable alternatives to new vehicles, although the uptick is in part due to recent expansion of some manufacturers’ CPO programs to include a wider range of age and mileage.

1Disclaimer: The views and analysis provided herein relate to the vehicle remarketing industry as a whole and may not relate directly to ADESA US. The views and analysis are not the views of ADESA US, its management, its subsidiaries or its parent companies; and their accuracy is not warranted.

Forward-Looking Statements: The statements contained in this report and statements that ADESA US, its management, its subsidiaries or its parent companies may make orally in connection with this report that are not historical facts (including, but not limited to, expectations, estimates, assumptions and projections regarding the industry and business) may be forward-looking statements. Words such as “could,” “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “promises,” “likely to,” “outlook,” “potential,” “project” and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the “Risk Factors” identified in Carvana Co.’s Securities and Exchange Commission filings. Neither ADESA US nor its subsidiaries or parent companies undertakes any obligation to update any forward-looking statements.