Supporting Our Clients for 70 Years with Insurance Technology

Mitchell was founded in Glenn Mitchell’s garage 70 years ago. The world has changed a lot since 1946, and Mitchell has evolved right along with it. While remaining true to our roots in collision repair, we’ve expanded our reach into auto physical damage, auto casualty, workers’ compensation, out-of-network solutions, and now pharmacy. Another way we’ve evolved is through the adoption of technology. We’ve come a long way since our manuals were printed on paper—and the current explosion of both available and emergent technologies promises further change and opportunity. As we look toward the future, we anticipate ongoing evolution, but here’s what will remain the same: we’ll continue to focus on technology, expertise and connecting to bring additional value to our clients. We’ll also continue to support the important work they do by focusing on empowering better outcomes.

Another way we’ve evolved is through the adoption of technology.

As part of our ongoing celebration of our 70th anniversary, we asked President and CEO, Alex Sun, about some of the technology and trends that are not only changing the world we live in, but also having an impact on both insurers and collision repairers.

Read part II of our 70th anniversary interview.

What technology and trends are you following that you anticipate will have an impact on the P&C industry?

There are a number of big trends that are affecting the entire industry. The first is a general recognition that in order to remain competitive you need to have the right technology infrastructure to do so. Many insurance companies across all lines of coverage are beginning to go through very large scale technology transformations, starting with either their claims systems, their policy administration systems or their billing systems.

Many insurance companies across all lines of coverage are beginning to go through very large scale technology transformations.

The intent is to create a unified, scalable and extensible environment so they can create new experiences and new capabilities for reaching out to their customers and managing them. A second major trend that is really just starting to emerge, is we’re all beginning to recognize there is real, tangible, practical use for things like machine learning or artificial intelligence. We’re beginning to pilot ways to leverage these types of technologies, marrying them with the vast amounts of data we captured in our systems to drive either better decisioning, or using machines to automate tasks that may have historically been done by individuals.

3 key trends impacting the insurance industry

1. McKinsey.com | 2. Deloitte.com | 3. McKinsey.com

And the third trend I’m seeing is the focus on the digital consumer experience. Insurance, generally, is a very competitive marketplace. One area where many carriers, particularly on the personal lines side, are beginning to focus as a point of differentiation is on creating interesting consumer experiences. This encompasses everything from how they quote, to how they manage their daily interactions, to how they handle a claim. With the ubiquity of mobile smartphones and increased access to broadband, we’re beginning to see clients embracing major digital consumer initiatives.

Other things that are impacting the insurance industry, both in favorable ways and in ways that need to be considered as they relate to future business models, are technologies like the Internet of Things—whether that’s the connected car, the self-driving car or nanotechnology related to healthcare. These are part of a spectrum of new technologies being deployed that will not only affect how customers expect to be interacted with, in terms of either buying insurance or having their claims handled, but also how companies themselves will operate.

What trends are top-of-mind for you in auto physical damage?

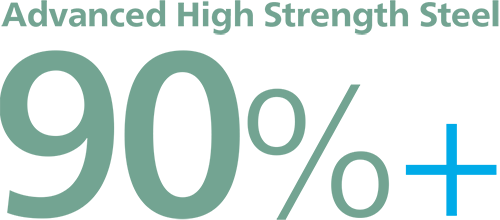

On the auto physical damage side, there are a number of external pressures affecting collision repair shops that are creating an incredibly complex operating environment. These trends are causing them to seek more sophisticated technology solutions to operate efficiently and meet the demands of OEMs, insurance companies and consumers. First off, advances in automotive manufacturing—the incorporation of more sophisticated materials, technology and safety features—are making it even more complicated to repair a vehicle today. And it raises the question, for the first time in a decade or so, of whether or not cars are being repaired safely and correctly. So not only is it extremely important for repair shops to have access to the information they need to repair a car and certify that it was repaired correctly, it also increases the burden on them to invest in both training for their staff and new equipment.

The changing face of automotive materials

1. Ducker Worldwide. (2015). Metallic Material Trends in the North American Light Vehicle. Accessed online Aug. 3, 2016. 2. Ducker Worldwide. (2014). 2015 North American Light Vehicle Aluminum Content Study. Accessed online Aug. 3, 2016.

Insurance companies, for their part, are becoming increasingly reliant on collision repair partners in their vehicle repair programs to manage more administrative and customer service-oriented tasks like estimating, coordinating vehicle rentals and ultimately, doing whatever it takes to get an owner back into their vehicle.

Today, we’re really focused on the technologies collision repair shops need to employ to allow them to operate more efficiently.

In addition, many insurance companies are focused not just on the safety and quality of a repair, but also on the timeliness of the repair process. This puts significant pressure on the collision repairer to make sure they can perform their work not only cost efficiently, but also on a timely basis, and with regular status updates. As a result, collision repairers are looking to leverage technology to do things like streamline parts procurement and manage client scheduling. Lastly, consumers are driving another big trend that is affecting collision repair shops—and really operators of any small business. More consumers are looking for outside information sources to aid them in making decisions on what collision repair shop to work with, and social media is increasingly influencing this decision. I believe now more than ever, collision repairers are going to need to be smart about how they leverage social media and their presence on the web in order to position themselves for success.

Today, we’re really focused on the technologies collision repair shops need to adopt to allow them to operate more efficiently, especially with all the increased demands placed on them by OEMs, insurance companies and consumers—as well as the changes in what is required to deliver a safe repair.

Are there any trends specific to auto casualty that you are following?

One trend that’s having a big impact on auto casualty insurers is that both frequency and severity continue to rise. Cost containment solutions that address these issues are top of mind both for us and for our clients. On the first party side, we continue to look for ways to adapt elements of a managed care cost containment model to a non-managed care setting in order to drive more efficient, accurate claims outcomes. Whether we’re focusing on provider networks, out-of-network discounting capabilities, out-of-network pricing capabilities, nurse review, or even pharmacy, we’re really taking a lot of the concepts that have evolved in the managed care world and adapting them for use in the auto casualty model. On the third party side, there’s been about a 12 percent increase in bodily injury claims costs over the last five years. The average use of medical services is up about 18 percent, and many injuries are becoming more expensive to diagnose and treat. As a result, our insurance carrier clients are operating in an environment in which, more than ever, they need to keep third party claims costs in check.

The rising cost of third party claims

At the same time, the adjuster workforce demographics are starting to change. Many seasoned adjusters are now reaching retirement age, so there is a loss of expertise in an extremely complex space. It’s becoming imperative for the insurance industry to adopt technologies that allow them to codify in a system the best practices of their third party adjusters. That’s a big focus point for us—it’s a problem we’re really working to solve.

What trends are you seeing in workers’ compensation?

The workers’ compensation market has been dynamic for quite some time, due in part to the recession. It’s further complicated by an equally dynamic market on the healthcare delivery side. The consolidation that’s taking place with health insurers, health systems and managed care organizations—and, of course, the implementation of the Affordable Care Act—are all contributing factors. Despite a small decline in the volume of claims, we’re continuing to see rising medical care costs.

It’s become even more important for our workers’ compensation clients to focus on enabling technologies that allow them to operate their organizations more effectively and efficiently.

Another trend that is contributing to this dynamic environment is the dramatic rise in opioid abuse. In fact, there were a record number of drug-related deaths in 2014, and 61% of these were caused by opioids. This prompted the CDC to issue new prescribing guidelines earlier this year. Many states and organizations such as the Work Loss Data Institute that publishes the Official Disability Guidelines are also tightening their recommendations to keep patients safe and curb the threat of addiction. Because of these factors, we’re seeing an increased focus on pharmacy benefit management as a way to more appropriately manage the distribution of opioids and to keep claimants safe and on the road to recovery. As a result of these trends, it’s become even more important for our workers’ compensation clients to focus on enabling technologies that allow them to operate their organizations more effectively and efficiently. Our clients are looking to use technology to more tightly integrate with the other service providers and partners they interact with throughout the claims resolution process. They’re also looking for ways to leverage data that is captured in the use of these technologies, in a way that gives them greater insight into cost drivers and helps them deliver better outcomes for their organizations and their claimants.